March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web if you’re selling or closing the business for good, file a final return. Filing deadlines are in april, july, october and january. Web choose setup > clients and click the payroll taxes tab. You can do this by checking the box on line 17 of form 941, write the date you last paid out.

Filing deadlines are in april, july, october and january. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web choose setup > clients and click the payroll taxes tab. Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later. Web this form must be filed by the 15th day of the fourth month after you close your business.

Edit, sign or email irs 941 & more fillable forms, register and subscribe now! Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that your business has closed and that you do not need to file returns in the. Web this form must be filed by the 15th day of the fourth month after you close your business. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Ad get ready for tax season deadlines by completing any required tax forms today.

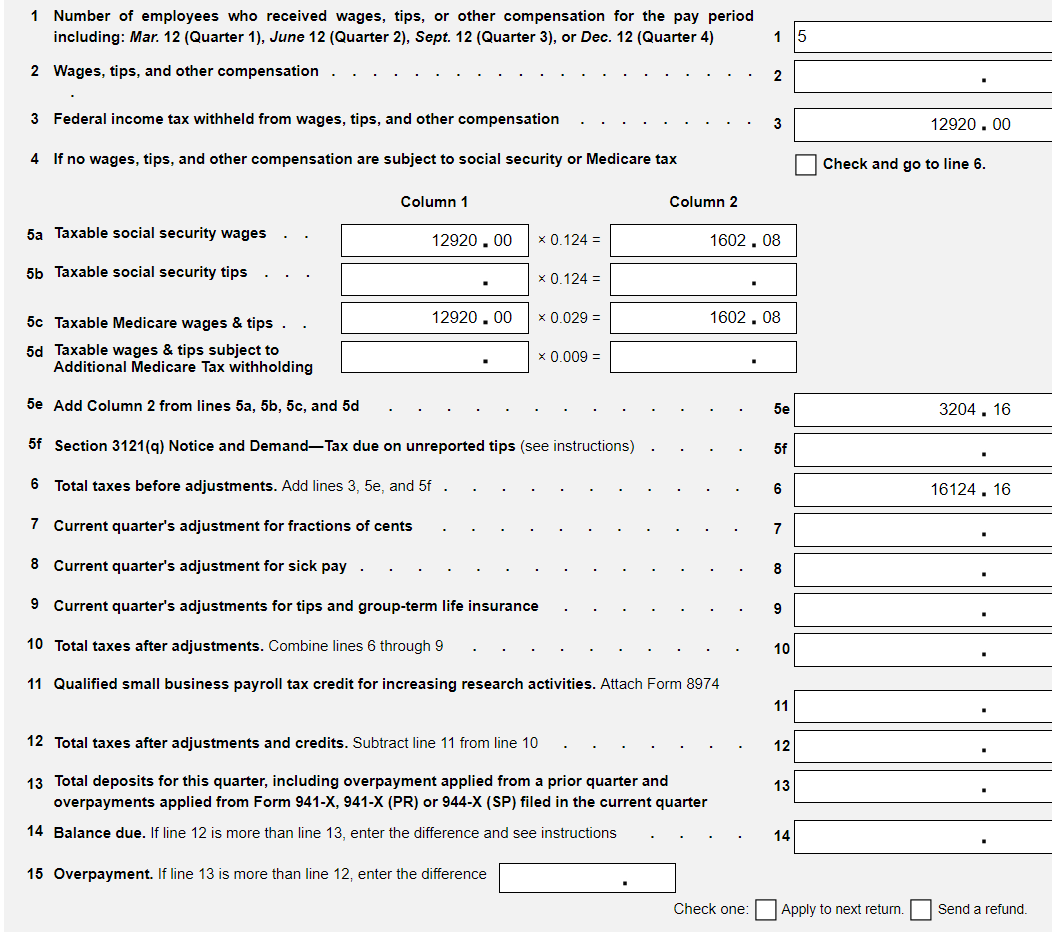

Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that your business has closed and that you do not need to file returns in the. Web to tell the irs that form 941 for a particular quarter is your final return, check the box on line 17 and enter the final date you paid wages. Web form 941 is filed quarterly and is used to report federal income taxes and social security and medicare tax withheld from employees' pay. Web if you’re selling or closing the business for good, file a final return. Web you can handle your final payments and filings yourself, print your forms and submit it directly to the irs and state agencies along with your tax payments. Web check the box to tell the irs your business has closed and enter the date final wages were paid on line 17 of form 941 or line 14 of form 944. Ad get ready for tax season deadlines by completing any required tax forms today. You can do this by checking the box on line 17 of form 941, write the date you last paid out. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Check the box on line 16, and enter the date final wages were paid indicating that your business has closed and that you do not need to file returns in. Ad signnow.com has been visited by 100k+ users in the past month Web the statement should list the new owner's name, new form of business, date of change, and the name and address of person keeping payroll records. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web you can probably simply file another 941 with the box checked and the requisite statement attached (print and mail) in addition to which you can include a line. Web up to $32 cash back the irs released the final instructions for the updated form 941 in june of 2022, ahead of the second quarter’s end.

March 2023) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service Employer Identification Number.

Corporations also need to file irs form 966, corporate dissolution or liquidation, to. Web print the federal form 941. Edit, sign or email irs 941 & more fillable forms, register and subscribe now! Web if you’re selling or closing the business for good, file a final return.

In The Forms Section, Click The Additional Information Button For The Federal 94X Form.

Click the final statement button. Under forms, click the quarterly forms link. Web check the box to tell the irs your business has closed and enter the date final wages were paid on line 17 of form 941 or line 14 of form 944. Web for the best experience, open this pdf portfolio in acrobat x or adobe reader x, or later.

March 2021) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service Employer Identification Number (Ein) —.

Web forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: Web form 941 is filed quarterly and is used to report federal income taxes and social security and medicare tax withheld from employees' pay. Web you can handle your final payments and filings yourself, print your forms and submit it directly to the irs and state agencies along with your tax payments. Web up to $32 cash back the irs released the final instructions for the updated form 941 in june of 2022, ahead of the second quarter’s end.

You Can Do This By Checking The Box On Line 17 Of Form 941, Write The Date You Last Paid Out.

Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that your business has closed and that you do not need to file returns in the. Ad get ready for tax season deadlines by completing any required tax forms today. There are five parts that need. Web the statement should list the new owner's name, new form of business, date of change, and the name and address of person keeping payroll records.